Notifications of the government deficit and debt

| Notification of government deficit and debt | October 2013 |

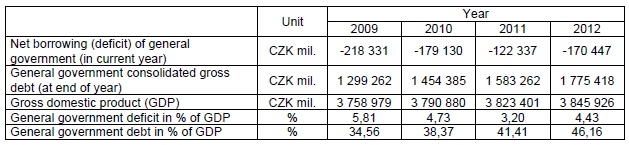

The notification of government deficit and debt is compiled for the past four years and submitted to the European Commission by each Member State of the EU twice a year, regularly at the end of March and September, including a projection for the current year. The calculation of the requested aggregates is based on the methodology of the European System of Accounts (ESA95). Pursuant to the Maastricht criteria, the deficit and the cumulated debt should not exceed 3% of GDP and 60% of GDP, respectively.

Government surplus/deficit – EDP B.9 - refers to net borrowing (-) or net lending (+) including interest on swap transactions. It shows the ability of the general government sector to finance other entities (+) or the need of the general government sector to be financed (-) in the given year.

Government debt includes, by definition, liabilities of the general government sector resulting from currency emissions (not applicable to the CR), received deposits, issued securities other than shares (except for financial derivatives), and received loans.

Indicators given in the table were transmitted to Eurostat at the end of September 2013. Compared to the notification in April 2013, the deficits in 2010 and 2011 were revised due to refining the estimation of investment expenditures (-0.08 percentage point of GDP in 2010, -0,05 p.p. in 2011). The deficit in 2012 was slightly changed upwards (+0.03 p.p.) due to revised estimation of taxes, investment expenditures and by incorporation of annual statistical questionnaires.

The amount of debt was impacted by important revision back to 2009. Increase in debt is a result of change in evaluation of the government bonds which are denominated in foreign currencies. In case of bonds hedged against currency risk, the amount of debt in foreign currency is converted to the domestic currency by use of contractual exchange rate instead of market exchange rate. This revision caused increase in the debt in 2009 by 13,3 billions (+0.35 p.p.), 17,5 billions in 2010 (+0.45 p.p.), 14,3 billions in 2011 (0.37 p.p.) and 16,5 billions in 2012 (+0.42 p.p.).

The projection of government deficit and debt for the year 2013 is prepared and published by the Ministry of Finance of the Czech Republic.

Statement of the European Commission is expected on 21nd April 2013.

Prague, 1st October 2013