Government deficit and debt - 4th quarter of 2019

General government debt decreased

Publication Date: 01. 04. 2020

Product Code: 050061-19

In Q4 2019, the general government sector balance decreased by CZK 10.8 bn compared to the corresponding period of the previous year, which was contributed to mainly by the central government, whose balance worsen by 7.7 bn. The local government sector balance reached the deficit of 10.4 bn, which was by 0.8 bn lower compared to the corresponding period of the previous year. Social security funds performance worsen by 3.9 bn, y-o-y, and reached the deficit of CZK 2.3 billion.

The general government sector balance, Q4 2017 – Q4 2019

Period | 2017 Q4 | 2018 Q1 | 2018 Q2 | 2018 Q3 | 2018 Q4 | 2019 Q1 | 2019 Q2 | 2019 Q3 | 2019 Q4 |

CZK bn | 0.5 | 2.4 | 41.8 | 15.8 | -10.7 | -2.8 | 26.8 | 12.9 | -21.5 |

% of GDP | 0.04 | 0.19 | 3.13 | 1.17 | -0.76 | -0.22 | 1.90 | 0.89 | -1.45 |

Note: Data in the table are not seasonally adjusted and cannot be compared quarter-on-quarter.

The total government revenues increased by 4.2% compared to the corresponding period of the previous year. Especially the following contributed to the y-o-y increase in revenues: growth of revenues from received social contributions (+6.6% to CZK 232.5 bn), taxes on production and imports (+6.5% to CZK 182.4 bn). Revenues from income tax raised by 0.8% to CZK 121.8 bn, while revenues from capital transfers decreased by 7.3% to CZK 17.4 bn. as well as current transfers declined by 2.9% to CZK 15.9 bn.

The total government expenditure increased by 5.9%, y-o-y. The following contributed the most to the expenditure growth: increase of the volume of paid income tax (+23.7% to CZK 1.5 bn), subsidies (+12.3% to CZK 32.0 bn), compensation of employees (+11.1% to CZK 157.5 bn) and gross capital formation (+9.5% to CZK 76.1 bn). On the contrary, expenditure on current transfers declined by 25.7% to CZK 20.5 bn and paid capital transfers decreased by 2.7% to CZK 10.2 bn.

The government debt ratio decreased from 32.58% to 30.79% of GDP whereas the increasing nominal GDP contributed to a decrease in indebtedness by 1.90 p. p. The nominal debt of the general government increased by 5.8 bn to CZK 1 740.5 bn and its contribution amounted to +0.10 p. p. In the quarter-on-quarter comparison, the debt ratio dropped by 1.19 p. p. The nominal debt decreased by 42.5 bn, q-o-q, and contributed to the decrease in the indebtedness by 0.76 p. p. while the influence of the increasing GDP was 0.43 p. p.

Regarding the structure of the debt, the y-o-y increase was caused by issued debt securities (+2.8%), whose share on the total debt increased to 91.8%. The volume of issued debt securities raised by CZK 43.6 bn, y-o-y, the volume of received loans declined by 34.2 bn, of which short-term by CZK 30.5 bn. A quarter-on-quarter decrease was observed as for all main components of the debt; issued debt securities decreased by 2.4% and received loans by 1.5%.

Debt of the general government sector, Q4 2017 – Q4 2019

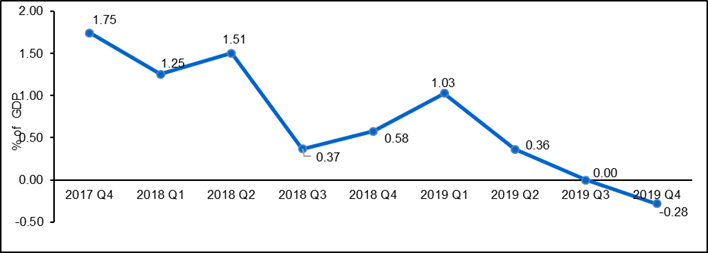

The general government sector balance after seasonal adjustment as well as adjustment for calendar effects ended up with a deficit of CZK 4.0 bn, which corresponds to 0.28% of GDP. In the q-o-q comparison, the adjusted balance dropped by CZK 4.0 bn. The development of the general government sector balance adjusted by seasonal and calendar effects is shown in the chart below.

Seasonally adjusted general government sector balance, Q4 2017 – Q4 2019

Notes:

Quantification of fiscal indicators of government deficit and debt mentioned above is based on the ESA2010 methodology. Data published in this release are methodologically consistent with the data used for the statistics of the excessive deficit procedure (EDP) purposes and for the assessment of how Maastricht convergence criteria are met.

The government surplus/deficit is represented by the item B.9 “net borrowing (−) or net lending (+)” in the system of national accounts. It refers to the ability of the general government sector to finance other sectors of the economy (+) or the need of the general government sector to be financed (−) by other sectors of the economy in the given period.

The general government debt is the amount of consolidated liabilities of the general government sector comprising the following items: currency and deposits, debt securities, and loans. In case of foreign exchange debt instruments hedged against the currency risk, the value in CZK is obtained by means of the contractual exchange rate.

The general government sector balance is compared with the amount of the GDP in the given quarter at current prices. The amount of consolidated general government debt is compared with the sum of quarterly GDP for the last four quarters at current prices. Fiscal indicators of quarterly government deficit and debt are published within the Transmission programme (Table 25 and Table 28) on the website www.czso.cz in the “GDP, National Accounts” section.

(http://apl.czso.cz/pll/rocenka/rocenka.indexnu_gov?mylang=EN)

Unless otherwise stated, data are not seasonally adjusted as well as they are not adjusted for calendar effects.

Contact person: