Notifications of the government deficit and debt

| Notification of government deficit and debt | October 2014 |

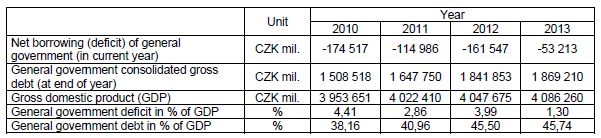

Notification of government deficit and debt is compiled for past four years and submitted to the European Commission by each Member State of the EU twice a year, regularly at the end of March and September, including a projection for the current year. Starting from September 2014, quantification of the aggregates must be based on the methodology ESA 2010. Pursuant to the Maastricht criteria, the deficit and the cumulated debt should not exceed 3% of GDP and 60% of GDP, respectively.

Government surplus/deficit is represented by item B.9 “net borrowing (-) or net lending (+)” in national accounts. It refers to the ability of general government sector to finance other sectors (+) or the need of particular sector to be financed (-) in the given year.

Government debt consists of liabilities of general government sector in form of currency and deposits, debt securities and loans. In case of foreign exchange debt instruments hedged against currency risk, value in CZK is obtained by use of contractual exchange rate.

Indicators mentioned in the table were transmitted to Eurostat at the end of March 2013. Currently published information on absolute and relative value of government deficit and debt contains methodological changes requested by the methodology ESA 2010. From September 2014 onwards, all member states are obliged to provide data compiled in line with the methodology ESA 2010.

Compared to the notification in April 2014, government deficit has been changed due to implementation of methodological changes resulting from ESA2010 especially new treatment of interest rate swaps and revised delimitation of general government sector. At the same time, revision of government deficit in 2013 is partly caused by data from annual statistical questionnaires not available for notification in April 2014 and revised information on taxes collected by government.

The relative level of government deficit is impacted by the revision in nominal GDP (by 5.2 % in 2013) as a reflection of the methodology ESA 2010. By implementation of the revised rules, government deficit for 2013 has been reduced by 0.15 percentage points to 1.3 % of GDP. It is worth to mention, that government deficit in 2011 has been revised downward from 3.2 to 2.86 % of GDP, i.e. below the threshold set by Maastricht criteria.

The relative level of government debt to GDP has been changed mainly due to two dominant factors, i.e. the upward revision in GDP having tendency to reduce the relative indebtedness and the revision in delimitation of general government sector having an opposite impact. As a result, the relative level of government debt for 2013 has been reduced by 0.3 percentage points (to 45.74 % of GDP) compared to the April notification (46.04 % of GDP). The change in trend in last year is notable; while according to ESA 95 methodology, government debt has declined by 0.11 percentage point in 2013, according to currently applied methodology the relative debt has increased by 0.24 percentage points during this year.

The projection of government deficit and debt for the year 2014 is prepared and published by the Ministry of Finance of the Czech Republic.

Statement of the European Commission is expected on 21nd April 2014.

Prague, 1st October 2014