Notifications of the government deficit and debt

| Notification of government deficit and debt | October 2009 |

The notification of government deficit and debt is compiled for the past four years as a rule and submitted by each member state of the EU twice a year, regularly at the close of March and September, including a projection for the current year. The calculation of the aggregates requested relies on the methodology of the European system of national accounts (ESA 95). Pursuant to the Maastricht criteria, the deficit and the cumulated debt should not exceed 3% of GDP and 60% of GDP respectively.

The government deficit/surplus and the government debt reflect the financial performance of all institutional units classified to the general government sector – they are governmental departments, territorial self-governing units, some semi-budgetary (subsidized) organizations, state and other extra-budgetary funds (Land Fund, Support and Guarantee Agricultural and Forestry Fund, or Vine-grower Fund), Railway Infrastructure Administration, transformation institution Prisko, PPP Centre, public universities, public research institutions and health insurance companies, association and unions of health insurance companies and Centre of Interstate Settlements.

Government surplus/deficit – EDP B.9 - refers to net borrowing (-) or net lending (+) including interest on swap transactions. It shows the ability of the general government sector to finance other entities (+) or the need of the general government sector to be financed (-).

Government debt includes, by definition, liabilities of the general government sector resulting from currency emissions (not applicable to the CR), received deposits, issued securities other than shares (except for financial derivatives), and received loans.

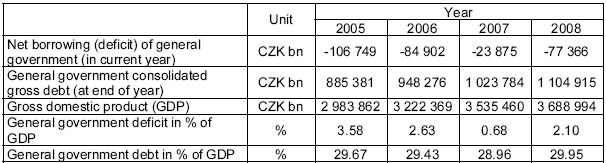

Indicators given in the table were transmitted to Eurostat on 31 October 2009. In comparison to the April 2008 notification, the 2007 and 2008 data have been updated using more detailed and additionally obtained information, especially considering tax revenues, expenditures on non-financial assets and correction of EU grants estimate. It resulted in the increase of the estimate of deficit by CZK 2,3 billion in 2007 and by CZK 23,4 billion in the year 2008. In 2008, estimate of tax revenues decreased by 11,4 billion CZK and expenditure on acquisition of non-financial assets increased by 14,2 billion CZK (especially in the local government sector).

The projection of government deficit and debt for the year 2009 is prepared and published by the Ministry of Finance CR.

Statement of the European Commission can be expected in 22 October 2009.

Prague, 1 October 2009